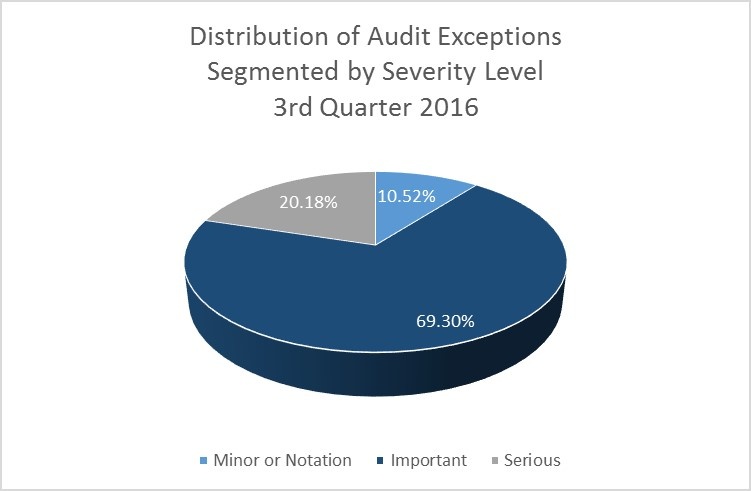

To identify frequently occurring mortgage Quality Control audit exceptions, TENA analyzed the findings from thousands of Production QC audits it completed during the third quarter of 2016. The distribution of audit exceptions, segmented by their severity level, is presented in the graph that follows.

The analysis of audit findings identified numerous post-closing and pre-funding audit exceptions that were frequently cited during the third quarter of 2016. Audit citations that TENA frequently noted during the third quarter of 2016 include:

1. Sufficient information for performing asset and income reverifications. (Severity = Notation)

This finding is most frequently noted due to missing address information on bank statements or employment documentation. As part of the audit process, TENA reviews the entire file to determine if there is an independently verified address documented in the file that can be used for sending the reverification. For example, an Internet printout evidencing the employer’s address is a sufficient form of validating the address that we can use for sending the reverification. Relying on the address reflected on the application is tantamount to accepting the income figures provided for a stated income loan. It may be accurate, but it may be fictional since it came from the borrower who may have listed their mother’s address in order to conceal their true employment status or over-inflate their income or assets.

Addresses should be reviewed during the loan production process for red flags, such as, do they match the borrower’s address history on the credit report, a possible red flag for undisclosed self-employment or a non-arm’s length transaction. Generally speaking, Quality Control audits touch only a fraction of the mortgage loans a lender originates, so when lenders consistently accept incomplete documentation of income, employment or assets it can be evidence of a breakdown in the entire process and places the lender in a negative position for additional risk of repurchase. Efforts to later determine an address and send the reverification do not mitigate the issue, a breakdown in the loan production process, which needs to be corrected on all loans and not just the representative sample reviewed.

2. QM/ATR status and documentation issues. (Severity = Ranges from Notation to Serious)

TENA has seen an increase in Qualified Mortgage/Ability to Repay (QM/ATR) findings in the third quarter related to missing documentation. The most prevalent finding relates to the ability to determine which QM/ATR standard the lender intended for the loan. Without knowing if the loan should follow QM standards or ATR standards TENA is defaulting to testing for ATR standards, rather than the safe harbor of a loan that meets Qualified Mortgage standards. Documentation of the intended standard should be provided in the file so that the loan can be tested to the intended QM/ATR standard.

Another frequently found issue regarding QM/ATR is missing Note and/or Closing Disclosure documents on loans designated as Qualified Mortgages. Without the Note and Closing Disclosure the points and fees test that Qualified Mortgages are subject to cannot be performed. The same is true with missing credit documents on loans designated as meeting Ability to Repay standards. The standard requires that a reasonable, good-faith ATR evaluation must include eight underwriting factors when assessing the consumer’s ability to repay the loan: (1) current or reasonably expected income or assets; (2) current employment status (if employment income is relied upon when assessing the ability to repay); (3) the monthly mortgage payment for the subject loan; (4) any additional monthly payments on the subject property; (5) additional monthly payments related to the subject property, such as insurance, taxes, homeowner association fees or ground rent; (6) debts, alimony and child support obligations; (7) monthly debt-to-income ratio; and (8) credit history. If a file is missing the credit report during the Quality Control audit, it cannot be evaluated to determine if the borrower met ATR standards for debts, alimony, child support obligations, the debt-to-income ratio, and credit history.

3. Complete legal description not reflected on appraisal. (Severity = Minor)

Fannie Mae, Freddie Mac and FHA all specifically state in their guidelines that the “Subject” section of the appraisal report must identify the subject property by providing a complete property address and legal description, the guidelines further require that if a legal description is lengthy, the appraiser may attach it as an addendum to the report. There are four types of legal descriptions: lot and block system, geodetic survey, government survey system, and metes and bounds description. Many appraisal reports reflect a shortened version of a complete legal address that is not in compliance with agency requirements.

4. The approval date reflected on the Direct Endorsement Approval (form HUD-92900-A) does not match the final Automated Underwriting report run date. (Severity = Minor)

FHA requires the lender to complete the approval of the loan terms section, on the Direct Endorsement Approval, with the approval date and the approval expiration date. TENA is frequently finding that the date on the Automated Underwriting report does not match the date on the Direct Endorsement Approval, which for all intents and purposes is the date the loan was approved when the loan was run through TOTAL. TENA must assume that the last AUS report in the file was the final approval, so we use the date of the last run for comparison. FHA has also included this finding as one of the most common file documentation errors in an August 2014 presentation on FHA Quality Control.

5. Missing Documentation (Severity = Ranges from Important to Serious)

The two documents TENA will highlight for missing in the third quarter of 2016 are:

– Evidence of an intent to proceed; and

– Evidence of changed circumstances.

Both of these frequently missing documents relate to the Truth-in-Lending RESPA disclosure requirements. The Consumer Financial Protection Bureau requires evidence of compliance that both the borrower’s intent to proceed and the changed circumstances that resulted in redisclosure of the Loan Estimate/Closing Disclosure are retained for three years after the later of the date of consummation, the date disclosures are required to be made, or the date the action is required to be taken. However, neither of the documents are required to be on a prescribed form. Although the number of lenders who are switching to a standard form within their shop to document these two requirements is increasing, it is acceptable to document them in any manner. Whichever documentation is used, it should be maintained as part of the loan file.