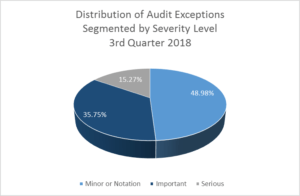

To identify mortgage origination Quality Control audit exceptions that occur frequently, TENA analyzed the audit results from thousands of Origination QC audits that it completed during the third quarter of 2018. The distribution of audit exceptions, segmented by their severity level, is presented in the graph that follows.

TENA’s analysis of audit findings identified numerous pre-funding and post-closing audit exceptions that were frequently cited during the third quarter of 2018. Those audit citations include:

- IRS Form 4506-T was ineligible for processing (Severity = Notation)

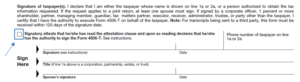

In September of 2015, the IRS updated Form 4506 and Form 4506-T to include a check box in the signature section. When checked, the tax payer attests he, she, or they have the authority to sign and request the information indicated on the form. Since March 28, 2016, the IRS has refused to process these forms or provide transcripts unless this box has been checked.

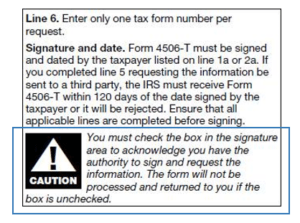

There is also a caution flag in the instructions concerning this checkbox (see provision outlined below):

TENA is frequently unable to process 4506-T forms because they do not have the attestation box checked. Additionally, TENA frequently has been unable to process Form 4506-T with the IRS because the forms found in the file listed a designee on Line 5 that is other than TENA. The IRS will process the 4506-T at TENA’s request only if the designee is shown as TENA. Tax transcripts are a post-closing QC reverification requirement on all files where the Investor is Fannie Mae, Freddie Mac, or Federal Home Loan Bank. They are also a conditional requirement for FHA loans. Without a correct 4506-T form in the file, TENA is unable to complete the required agency reverifications.

The IRS has also made changes to the information that is displayed on the Tax Transcripts that it does provide. Since 2005, when the IRS joined in partnership with the states and tax industry, inroads have been made in the effort to combat tax refund fraud that is based on stolen identities. As a result, it has become much more difficult for cyber criminals to file a fraudulent tax return that can effectively circumvent the IRS’s improved security safeguards. Consequently, in order to perpetrate their intended crime, cyber criminals now must acquire more legitimate taxpayer information so that they might better impersonate their targeted victims.

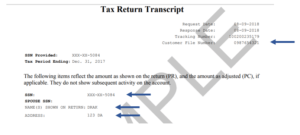

Therefore, to help prevent such efforts and further safeguard against identify theft, the IRS has modified the information that will appear on individual tax transcripts. Beginning September 23, 2018 (January 1, 2019 for IVES users), for tax transcripts returned through the mail the format of the individual tax transcript will be modified so that many data elements will be partially-redacted. The data fields include: names, addresses, SSNs, and the name of the employer. All monetary amounts will continue to be fully displayed.

As a result of the SSN being partially-redacted on transcripts of tax returns, requesters would often be unable to accurately match returned transcripts to the applicable borrower. To resolve that dilemma, the IRS has provided a Customer File Number field on the transcript request form. That field allows transcript requestors to assign a unique identification number identifying the borrower. The Transcript of Tax Return that is subsequently generated by IRS will then include the unique Customer File Number provided by the requesting party. In this manner, the redacted Transcript of Tax Return can accurately be matched to the applicable borrower, even though the SSN has been partially-redacted. (Obviously, that unique Customer File Number must not be the borrower(s) SSN.)

- Verbal verifications of employment are missing or outside of the required timeframes (Severity = Ranges from Notification to Serious)

Verbal verifications of employment can be performed after closing and in some cases, as late as “time of delivery” to the investor. However, not having completed the task by the time the file is subjected to audit suggests that the requirement might easily be missed. Failure to complete this required reverification can have a significant impact on the salability of the file if it is later discovered that a borrower was not employed when the loan closed. TENA analytics have shown a 3% increase in the number of borrowers who were not employed at closing over the last year.

To ensure that this required reverification is systematically completed in all cases, TENA recommends that clients review their internal closing procedures to determine if sufficient triggers are in place to initiate the verbal employment verifications in a consistent and timely manner. For example, one approach would be to establish a routine procedure that initiates (and documents in the loan file) the reverification effort at the time the final Closing Disclosure is provided. Another approach would be to initiate the reverification process upon receipt of the executed closing documents from the closing agent. Any trigger is acceptable, the goal being to ensure that the reverification is systematically completed on all applicable loan transactions.

- The file was missing a documented changed circumstance (or evidence of an appropriate cure) for changes in fees on the closing disclosure that exceed tolerances (Severity = Serious)

Although there has been a 40% decrease in the number of times that TENA has cited this finding in the last year, it is still the highest cited exception related to the Closing Disclosure. Previously, tolerance related findings were primarily attributable to the mandated fee-rounding protocol that is applied to the Loan Estimate and the exact fee requirement on the Closing Disclosure. For the 3rd quarter of 2018, the majority of the issues related to such tolerance violations were attributable to increases in fees made using a revised Closing Disclosure without valid changed circumstance documentation in file.

Prior to the issuance of the 2018 TILA-RESPA Rule (the 2018 Rule), a creditor could not use a Closing Disclosure to reset tolerances if there were fewer than four business days between the time the creditor was required to provide the Closing Disclosure that reflected the revised estimate and the time of loan consummation. The 2018 Rule removed that four business-day limitation. That means if a changed circumstance (or another triggering event) occurs, a creditor may reset tolerances with either an initial or a revised Closing Disclosure, regardless of the number of days that remain between the date the revised Closing Disclosure estimate was required to be provided to the consumer and the date of loan consummation. That notwithstanding, the 2018 Rule also requires that the revised Closing Disclosure be provided only if the disclosure is:

1) Provided to the borrower at or before loan consummation; and

2) Provided to the borrower within three business days of receiving information sufficient to establish that the changed circumstance (or other triggering event) has occurred; and

3) Provided only if the borrower received an initial Closing Disclosure at least three business days prior to consummation.

Even under the new 2018 Rule, there needs to be a documented changed circumstance in order to revise the fees. Without the documented changed circumstance, a tolerance violation may be incurred.

- The Loan Originator’s name does not match the NMLS database (Severity = Notation)

The Truth-in-Lending Act (§1026.36(g)) requires that the name of the loan originator shown on loan documents must be “as the name appears” in the Nationwide Multistate Licensing System (NMLS). However, it is not uncommon to find that in the NMLS, a loan originator’s full name may be reflected as, for example, Jonathon A. Smith while the loan documents list the name as Jon Smith. To be in compliance with the regulation: a) the loan originator’s name must be displayed on loan documents as Jonathon A. Smith to match the NMLS listing; or b) in the NMLS listing for that individual, the name Jon Smith must be entered under the Other Names section of the Jonathon A. Smith record.

- QM/ATR status and documentation issues (Severity = Ranges from Notation to Serious)

TENA has identified an increase in Qualified Mortgage/Ability to Repay (QM/ATR) findings in the third quarter that are attributable to missing documentation. The most prevalent finding relates to the ability to determine which QM/ATR standard the lender intended to be used for the loan transaction. The ATR standard is significantly less stringent than the requirements under the QM standard. When there is no evidence in the file indicating whether the QM standards or ATR standards should be followed, TENA defaults to testing for ATR standards as versus testing to determine safe harbor under the QM standards. Documentation of the intended standard should be provided in the file so that the loan can be tested to the intended QM or ATR standard.