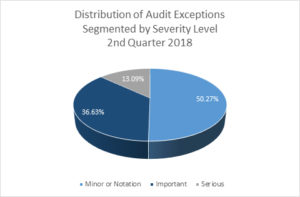

To identify mortgage origination Quality Control audit exceptions that occur frequently, TENA analyzed the audit results from thousands of Origination QC audits that it completed during the second quarter of 2018. The distribution of audit exceptions, segmented by their severity level, is presented in the graph that follows:

TENA’s analysis of audit findings identified numerous pre-funding and post-closing audit exceptions that were frequently cited during the second quarter of 2018. Those audit citations include:

- Borrower not employed at closing (Severity = Serious)

It is interesting to note that more than 21% of the files where the borrower was not employed at closing were Early Payment Defaults. Additional analysis of the files also revealed that 66% of the files were for purchase transactions and 26% involved cash-out refinances. The finding constitutes a serious defect because the loans are no longer saleable to investors or eligible for FHA insurance. Furthermore, if the loan has already been sold, it likely will require that the lender self-report the issue. In an effort to stem the occurrence of this finding, TENA recommends that: a) the lender perform the verbal employment verification(s) on or as close to the day of closing as possible; b) the lender clarify to the borrower(s) that the employment status represented on the application must remain true throughout the entire origination and closing process; and, c) the lender notifies the borrower(s) that it is a fraudulent act to sign the final application at time of closing if there has been a change in the represented employment status. (The Acknowledgement and Agreement section of the final application states that the information provided in the application is true and correct as of the date set forth opposite the borrower’s signature and that any intentional or negligent misrepresentation of this information contained in the application may result in civil liability, including monetary damages, to any person who may suffer a loss due to reliance upon any misrepresentation the borrower has made on the application, and/or in criminal penalties including, but not limited to, fine or imprisonment or both under the provision of Title 18, United States Code, Sec. 101, at seq.)

Fannie Mae has also recently published several lists naming potentially fraudulent California employers. Some of the trademarks of the purportedly fraudulent employers are the inability to reverify employment after closing, missing withholdings on paystubs, borrower has been on the current job for a short period of time, and high starting salaries. For the list of the employers cited as well as additional red flags, please refer to the Misrepresentation of Borrower Employment Scheme Alerts on Fannie Mae’s Mortgage Fraud Prevention page (https://www.fanniemae.com/singlefamily/mortgage-fraud-prevention).

- The Closing Disclosure was missing the Mortgage Insurance Case Number in the Loan Information section. (Severity = Important)

TENA’s analytics have revealed an increase in the number of findings related to missing details in the Loan Information section of the Closing Disclosure. Of particular note is missing Mortgage Insurance Case Numbers on loan transactions that have mortgage insurance. Under §1026.38(a)(5)(vi), when a creditor requires mortgage insurance, the Closing Disclosure must reflect the case number next to the label MIC#. https://www.consumerfinance.gov/eregulations/1026-38/2018-09243#1026-38-a-5-vi

- The subject property is located in a FEMA disaster area. (Severity = Notification)

The majority of the loans that were cited for potentially being impacted by a FEMA declared disaster were related to properties located in the vicinities where hurricanes Harvey and Maria caused damage. During recent months, there have been several other FEMA declared disasters related to fires in the West, severe storms in the Midwest and volcanic and hurricane activity in Hawaii. For loan transactions where the subject property is located in a FEMA declared disaster area (the list is located on https://www.fema.gov/disasters), if the loan has not closed or is closed but has not yet been delivered to the Investor, the lender is expected to take prudent and reasonable actions to determine whether the condition of the property has materially changed since the effective date of the appraisal report.

- Verified asset balances do not trace to the final application. (Severity = Minor)

TENA analytics have revealed that an increasing number of files have been cited for assets not tracing from the verified documentation to the final application. The final application should be the updated document that reflects the accumulated verified information. When information does not match, it can be an indication that the borrower’s assets are questionable.

There are two common types of fraud that may potentially be involved when the final application does not match the verified documentation; 1) The borrower no longer has sufficient funds in their bank account to meet the required cash to close and/or to cover required reserve amounts; or 2) the borrower has recently borrowed funds. Manipulation of assets needed for closing constitutes a prevalent type of fraud in loan transactions. Frequently borrowers have insufficient funds for the required down payment or want to preserve the assets that they do have. In this type of fraudulent activity, typically, if a borrower cannot or will not make the down payment, there are others involved in the transaction that are willing to provide the necessary assets, Most commonly this is done by the seller, builder or realtor. Take for example, a case where the borrower has to borrow money in order to have the required down payment funds necessary for closing. The verified documentation in the file reflects an amount less than what is reflected on the final application; however, the amount of assets considered during the automated underwriting process is pulled from the data entered on the final application. If the additional debt is not considered during the underwriting process, the funds borrowed may increase the debt ratio to an unacceptable level thereby increasing the chance that the loan will go into default.

- Charges reflected in Block H (Other) on the Closing Disclosure were not reflected correctly. (Severity = Important)

The good news is that TENA has observed a 33% decrease in the number of findings cited over the past year that are attributable to the Truth-in-Lending RESPA Integrated disclosures. However, one of the audit findings still frequently cited is related to the Other Costs section in Block H on the Closing Disclosure. The regulation requires that all required or optional charges attributable to the mortgagor, the seller, or any other party (plus the name of the recipient of such funds), be listed in the Other Costs section in Block H of the Closing Disclosure. In addition to the name of the payee, for each cost that is for a title related service, the word “Title –” must be entered as a prefix to the cost description. For each itemized cost for any premiums for separate insurance, warranties, guarantees, or event coverage products, the word “Optional” must be entered as a suffix to the cost description. TENA auditors have found that items listed in the Other Costs section frequently are missing either: a) the name of the payee; or b) the required term “Optional” is missing from the end of the cost description. The latter finding has particularly been noted when the listed cost involves Owners Title Insurance.

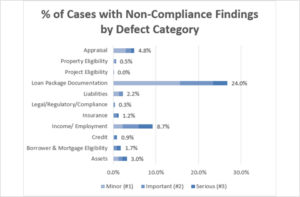

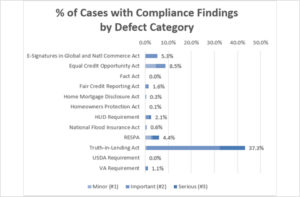

The graphs below reflect the percent of cases that were audited in the 2nd Quarter of 2018 with at least one exception in the defect categories reflected.