Fannie Mae Issues Selling Guide Announcement SEL-2025-02

Fannie Mae issued Selling Guide Announcement SEL-2025-02 (Announcement), setting forth updates to the Selling Guide. Per the Announcement, Fannie Mae is integrating Condo Project Manager

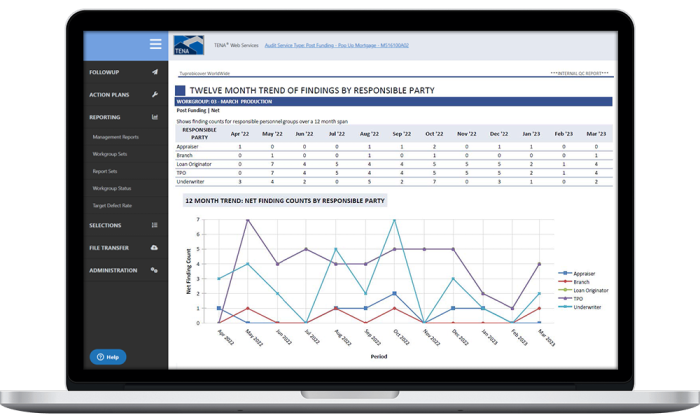

TENA Web Services (TWS) consolidates the Quality Control process into one easy-to-use platform, offering a comprehensive solution for everything from file transfers, audit follow-up, reporting, action planning and more.

By streamlining communication and interactions between you, TENA, and your QC staff, the TWS platform saves your organization valuable time and resources.

TWS is available to all TENA clients at no cost. Contact TENA today to discover how TWS can elevate your Quality Control process!

Optimize your ability to reconcile defects, lower your net defect rate, and effectively reduce lending risk with the TENA Web Services platform.

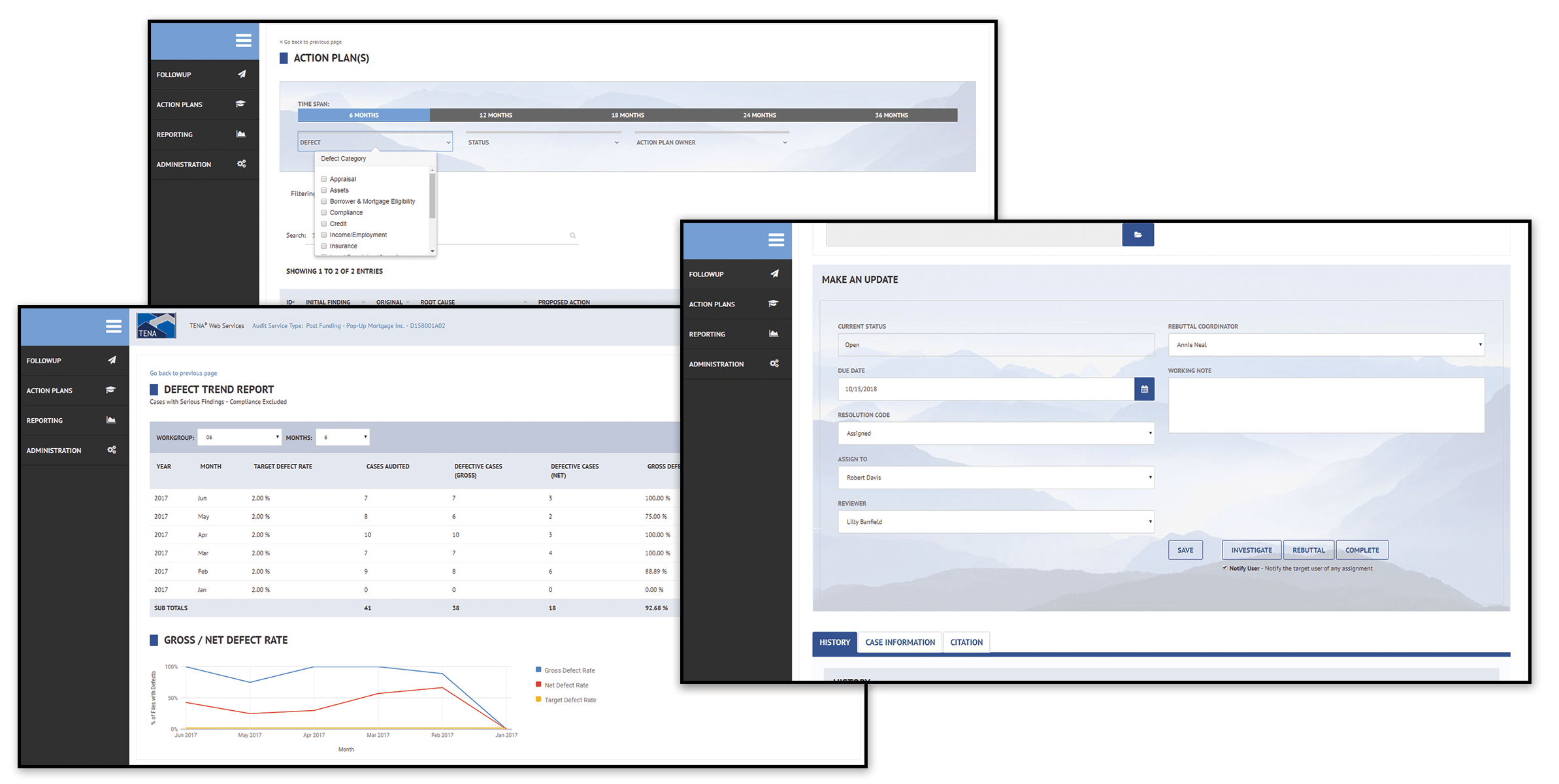

TWS allows you to assign defects to responsible individuals for resolution, dispute the original finding, quickly sort, view, remedy, assign, and address individual or multiple defects, add unlimited notes and comments to specific or multiple issues, view reports showing your net defect rate and more.

Watch the demo video below to get an inside look at TWS:

Import defects from your initial QC findings and display them as individual defects, allowing you to assign them for resolution, rebut the original finding, and more.

TWS comes complete with robust reporting tools and pre-built reports, such as the Defect Trend Report. Stay on top of your data and keep everyone on the same page for resolving defects.

Reduce deficiencies, create actionable plans and quickly communicate change to save time in your organization and effectively reduce your lending risk.

TENA covers every step in the mortgage review process, from Pre-Funding to Post-Closing to Servicing, and more!

Fannie Mae issued Selling Guide Announcement SEL-2025-02 (Announcement), setting forth updates to the Selling Guide. Per the Announcement, Fannie Mae is integrating Condo Project Manager

Fannie Mae revised the West Virginia Security Instrument Form (Form 3049). The revision updates paragraph 1 (pertaining to payment of principal, interest, escrow items, prepayment

Freddie Mac issued Bulletin 2025-4 (Bulletin) announcing revisions to the Single-Family Seller/Servicer Guide. Per the Bulletin, Freddie Mac introduced the Freddie Mac Income Calculator, designed

Sign up below to receive regulatory updates from Fannie Mae, Freddie Mac, FHA, individual state compliance and more, delivered right to your inbox.

You will also receive an email with a link to the PDF.