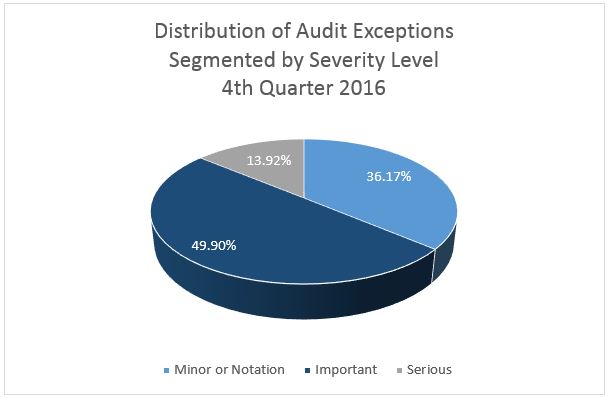

To identify mortgage production Quality Control audit exceptions that occur frequently, TENA analyzed the audit results from thousands of Production QC audits that it completed during the fourth quarter of 2016. The distribution of audit exceptions, segmented by their severity level, is presented in the graph that follows.

TENA’s analysis of audit findings identified numerous pre-funding and post-closing audit exceptions that were frequently cited during the fourth quarter of 2016. Those audit citations include:

- Borrower not employed at closing. (Severity = Serious)

TENA’s analytics initially identified this finding as an issue during the first quarter of 2016; however, it continues to be a frequently occurring finding in the fourth quarter as well. Further analysis of this finding indicates that 73% of the time it occurred, it involved a purchase transaction. This finding constitutes a serious defect because such loans are no longer saleable to investors or eligible for FHA insurance. Furthermore, if the loan has already been sold, it will require that the lender self-report the issue. In an effort to stem the occurrence of this finding, TENA recommends that: a) the lender perform the verbal employment verification(s) on or as close to the day of closing as possible; b) the lender clarify to the borrower(s) that the employment status represented on the application must remain true throughout the entire origination and closing process; and, c) the lender notify the borrower(s) that it is a fraudulent act to sign the final application at time of closing if there has been a change in the represented employment status. (The Acknowledgement and Agreement section of the final application states that the information provided in the application is true and correct as of the date set forth opposite the borrower’s signature and that any intentional or negligent misrepresentation of the information contained in the application may result in civil liability, including monetary damages, to any person who may suffer a loss due to reliance upon any misrepresentation the borrower has made on the application, and/or in criminal penalties including, but not limited to, fine or imprisonment, or both, under the provision of Title 18, United States Code, Sec. 101, at seq.)

- Missing explanations regarding inquiries on the initial credit report. (Severity = Notation)

When recent inquiries are reflected on the initial credit report, it is considered to be a red flag for possible future debt obligations attributable to recently opened credit accounts. Review credit reports obtained during TENA’s post-closing quality control audit frequently reflect accounts that were opened after the application but prior to the loan closing. Since the debts were either not disclosed or did not even exist at the time of loan origination, these additional liabilities were not considered in the debt ratio that was initially calculated for qualification. When these new obligations are included in the calculation, the recalculated debt ratio is frequently found to be outside of allowable tolerances. Not only can these recalculated debt ratios lead to a lender self-reporting to an Investor, they also add an additional layer of risk for possible future default.

The report entitled Fannie Mae’s February 2017 Misrepresentation Data provided information based on loan reviews that Fannie Mae completed through the end of January 2017. The report indicated that between 2015 and 2016, there has been a 10% increase in the number of loans where borrower’s liabilities were significantly misrepresented. To reduce this problem, the agencies recommend that: 1) lenders obtain written explanations for any recent credit inquiries from the borrower (inquiries within 120 days of the loan application); and 2) when the inquiries are from entities that have the potential to provide mortgages, auto loans, leases, or other installment loans, the lender should obtain a letter from the creditor providing a satisfactory explanation of the reason for the credit inquiry.

- Complete information in Block B (Services Borrower Did Not Shop For) on the Closing Disclosure. (Severity = Important)

TENA analytics found a significant increase in the frequency of incomplete information in Block B of the Closing Disclosure. Statute §1026.38(f)(2) specifically states that the name of the person (or entity) ultimately receiving such a payment must be reflected for each itemized cost. The most frequently identified issue regarding fees in block B involve a failure to provide the name of the entity to whom fees were paid for settlement services the lender required. In many of these instances, TENA has found that the identity of the applicable entity either: 1) was not reflected at all; or 2) a generic title, such as Title Company or Appraisal Company, was indicated. The most frequently identified fee categories that were mislabeled in this manner were: title fees; appraisal fees; tax service fees; and fees for mortgage insurance.

- The date the fees and terms of the Loan Estimate were set to expire was less than 10 business days from the date the initial Loan Estimate found in the file was issued. (Severity = Serious)

As with the previous Good Faith Estimate requirement, the combined Truth-in-Lending and RESPA disclosure regulation (TRID) still requires that lenders make the Loan Estimate fees and terms available for at least 10 business days from the date the initial Loan Estimate was issued (TILA 12 C.F.R. § 1026.19(e)(3)(iv)(E)). During the fourth quarter audits an increasing number of files were cited regarding this matter. The error is generally found in the Rate Lock section on page one of the Loan Estimate in the sentence that reads: “All other estimated closing costs expire on _________”. These audit citations appear to be related to two main causes: (1) an incorrect definition of a business day was utilized in the calculation, or (2) the lender failed to provide the actual initial loan estimate for audit.

In the first scenario, there appears to be confusion on the part of numerous lenders regarding how TRID guidelines define a business day. For the Loan Estimate timing requirement, the term “business day” means a day on which the creditor’s offices are open to the public for carrying out substantially all of its business functions. (See § 1026.2(a)(6).) When counting business days, day one is always the day after the Loan Estimate was issued – not the day it was issued. The business day definition may also change based on whether the lender’s offices are open to the public for substantially all business on Saturdays and Sundays.

In the second scenario, there have been numerous incidents noted where the lender apparently issued an acceptable initial Loan Estimate but did not include a copy of that document in the file that was tendered for audit. Consequently a revised Loan Estimate appeared to be the initial Loan Estimate and that resulted in an audit citation indicating that insufficient time was allotted for expiration. In those circumstances, the audit citation should have been failure to include all pertinent disclosure documents in the loan file.

- Missing Documentation (Severity = Ranges from Important to Serious)

The fourth quarter 2016 analytics revealed that there have been an increasing number of exceptions cited because the audited files were missing proof that initial disclosures were provided within three days of the application. This finding impacts multiple types of disclosures that are required to be provided to the borrower within the three day time frame, yet the prescribed form for the disclosure documents themselves does not include a date field. The most common examples of this issue involve: 1) the list of homeownership counseling agencies disclosure; s) the Home Loan Toolkit disclosure; and, 3) the For Your Protection: Get a Home Inspection disclosure.

Effective evidence that these documents were provided to the borrower in a timely manner include: 1) a dated cover letter that is included with the initial disclosures that lists all of the documents being provided; 2) an electronic log with a date/time stamp that lists the disclosures that were provided to the borrowers; 3) a screen print from the loan origination system that reflects the date the initial disclosures were provided to the borrowers. As usual, the burden of proof rests entirely with the lender.