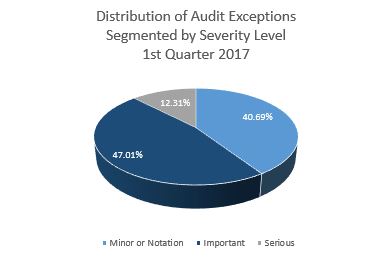

To identify mortgage origination Quality Control audit exceptions that occur frequently, TENA analyzed the audit results from thousands of Origination QC audits that it completed during the first quarter of 2017. The distribution of audit exceptions, segmented by their severity level, is presented in the graph that follows.

TENA’s analysis of audit findings identified numerous pre-funding and post-closing audit exceptions that were frequently cited during the first quarter of 2017. Those audit citations include:

- Discrepancies on Form 4506-T request for tax transcripts. (Severity = Ranges from Minor to Serious)

TENA’s analytics have revealed an increase in the number of discrepancies identified on Form 4506-T that have resulted in the IRS rejecting the request for tax transcripts. The majority of rejections are related to the address on Form 4506-T not matching the address the IRS has on record for the tax returns that are being requested.

Some of the issues that relate to the incorrect address have to do with the address being preprinted on Form 4506-T from the application data. Lenders appear to be using the subject property address when the loan is for a purchase transaction and the borrowers do not currently reside at the subject address. It is also common to see the address pulled from the application for the borrowers’ current address when they have resided at the current address for a shorter timeframe than the last tax year or when a different mailing address is reflected.

- Violations of the Truth-in-Lending – RESPA integrated disclosure requirements

Third party fees on the Closing Disclosure are improperly disclosed. (Severity = Important)

One of the most frequently occurring TRID violations in the first quarter of 2017 is associated with the placement of charges for fees that were paid to a vendor reflected on the List of Settlement Service Providers. The combined Truth-in-Lending and RESPA disclosure regulation states in statute §1026.38(f)(2) that services that the consumer can shop for must be disclosed under Block B (Services Borrower Did Not Shop For) if the consumer was provided a written list of settlement service providers and the consumer selected a settlement service provider contained on that written list. However, TENA analytics has identified that Lenders are frequently showing these fees in Block C (Services Borrower Did Shop For).

Block B fees are subject to the “no increase” requirement while Block C fees allow for a 10% tolerance in increased fees. Because the fees are reflected in Block C rather than in Block B there is an increased risk for an undetected tolerance violation.

The borrower was not provided the Closing Disclosure at least 3 precise business days prior to consummation. (Severity = Important)

Under statute §1026.19(f)(1)(ii), the Closing Disclosure must be received by the consumer no later than three business days before consummation. For example, if consummation is scheduled for Thursday, the creditor satisfies this requirement by hand delivering the disclosures on Monday, assuming each weekday is a business day. TENA analytics found a significant increase in the frequency of Closing Disclosures dated less than three business days prior to consummation or even dated the same day as consummation. The majority of these exceptions appear to be related to missing documentation supporting an earlier delivery date to the consumer.

In the Official Interpretation to 19(f)(1)(iii) if the creditor delivers the disclosures in person, consummation may occur any time on the third business day following delivery. If the creditor provides the disclosures by mail, the consumer is considered to have received them three business days after they are placed in the mail, for purposes of determining when the three-business-day waiting period begins. Alternatively, if properly documented, the creditor may rely on evidence that the consumer received the disclosures earlier than three business days after mailing. Creditors that use electronic mail or a courier other than the United States Postal Service may follow the same approach for disclosures provided by mail. For example, if a creditor sends a disclosure required under §1026.19(f) via email on Monday, pursuant to §1026.19(f)(1)(iii) the consumer is considered to have received the disclosure on Thursday, three business days later. Alternatively, the creditor rely on evidence that the consumer received the emailed disclosures earlier if such evidence is supported by documentation.

Missing the date and/or time the estimated closing costs expired on the Loan Estimate. (Severity = Important)

TENA analytics have revealed that the time zone is not being disclosed on the Loan Estimate for the estimated closing cost expiration date. In Supplement I to §1026.37(a)(13) the disclosure required by §1026.37(a)(13)(ii) requires the applicable time zone for all times provided, as determined by the creditor. For example, if the creditor is located in New York and determines that the Loan Estimate will expire at 5:00 p.m. in the New York time zone, the disclosure must include a reference to the Eastern time zone and clearly state if it is Standard Time or Daylight Savings Time (i.e., 5:00 p.m. EST).

- Sufficient information for performing asset and income reverifications. (Severity = Notation)

This finding is most frequently noted due to missing address information on bank statements or employment documentation. As part of the audit process, TENA reviews the entire file to determine if there is an independently verified address documented in the file that can be used for sending the reverification. For example, an Internet printout evidencing the employer’s address is an acceptable form of validating the address that can be used for sending the reverification. Without a documented address in the file, required elements of the entire Quality Control audit cannot be performed. During an Investor’s review of the lender’s Quality Control program, this reverification failure could potentially be cited as a deficiency.

- Missing documentation verifying that none of the participants in the mortgage transaction were debarred, suspended or otherwise ineligible to participate in an FHA transaction. (Severity = Serious)

TENA analytics have shown a significant increase in missing the required FHA documentation that supports participant’s eligibility in the mortgage transaction. FHA guidelines require that the mortgagee verify participant eligibility using the SAM Excluded Parties List, the Limited Denials of Participation list (LDP) and the National Mortgage Licensing System (NMLS), as applicable. The participant’s that must be checked include, but are not limited to:

– seller (excluding the seller of a Principal Residence)

– listing and selling real estate agent

– loan officer

– loan processor

– underwriter

– appraiser

– 203(k) consultant

– closing agent

– title company

TENA typically finds that many lenders provide supporting documentation related to the borrowers eligibility; however, the eligibility of other participants’ to the transaction are not supported by documentation.