Fannie Mae recently introduced Desktop Underwriter (DU) Validation, a service that impacts various Quality Control requirements. For lenders that opt-in to the new DU validation service, designated vendors, will be used to validate income and employment and assets during the origination process, each such validated item is referred to as a “component”. The service provides enforcement relief of certain representations and warranties for validated components and is being offered by Fannie Mae for no additional charge; however, lenders must set up agreements with the designated vendors and register with Fannie Mae to use each respective validation service.

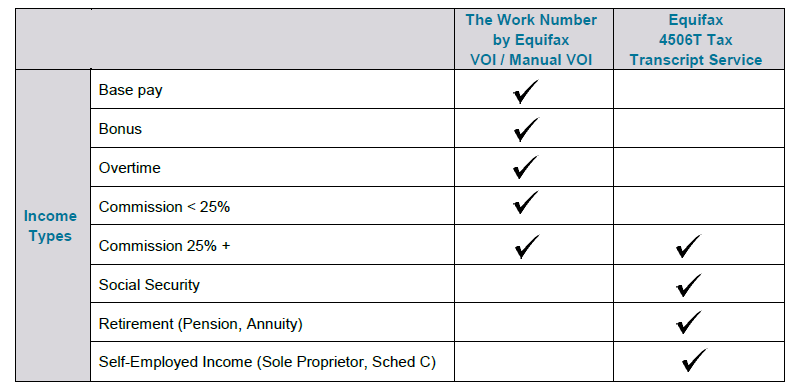

The current designated vendors are The Work Number from Equifax® and The Equifax 4506-T Tax Transcript Service for Income and Employment validation and AccountChekTM by FormFree for Asset validation. The process flows as follows:

- After obtaining borrower consent, the lender orders a verification report from a designated vendor.

- The lender reviews the report and addresses any discrepancies with the borrower.

- The information is entered and submitted to DU.

- DU obtains a duplicate copy of the report from the vendor using loan number or reference number.

- DU performs its own income and asset calculations to arrive at a value that is compared to DU and validates the borrower(s) employment status.

- DU returns specific messages related to the loan components that have been submitted for validation.

- Income is validated on a per-borrower and per-income type basis.

- Assets are validated on a loan-level basis.

- Employment is validated on a per-borrower and per-employer basis.

Currently only income validation is available for the following sources; however, employment and asset component validation are scheduled to be offered with the DU release on December 10, 2016.

For loans with a component validated by this DU process, the lender is not required to recalculate the validated income or assets as part of its pre-funding Quality Control review or reverify or recalculate the validated information as a part of the post-closing Quality Control process. A full reverification and recalculation would need to be performed as part of the QC review if any of the following components apply:

- Could not be or was not validated by DU

- Was not documented as required with the DU messages

- The validated information was inconsistent compared to file documentation

For additional information regarding the new DU Validation Service, refer to Fannie Mae’s Frequently Asked Questions.