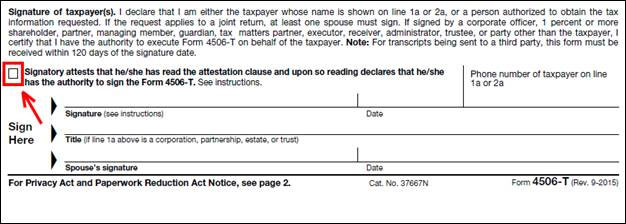

Recently the IRS updated Form 4506 and Form 4506T to include a check box in the Signature section. When checked, the tax payer attests they have the authority to sign and request the information indicated on the form. As of March 2016, the IRS will not process these forms or send transcripts unless this box is checked.

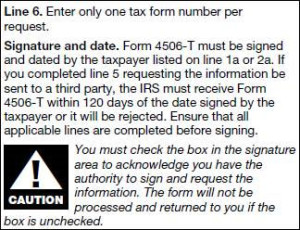

There is also a caution flag in the instructions concerning this checkbox:

The IRS has agreed to process the 4506 and 4506-T forms without the box checked for TENA until March 28, 2016. Any 4506 and 4506-T forms received after that date, without the box checked, will not be processed. If TENA orders tax transcripts for the loans you send in for review, be sure to provide 4506s and 4506-Ts that have this box checked.

Ordering tax transcripts is one of the many services that TENA has available. Below is a brief list of the services and audits that TENA offers that you may not be aware of:

- Prefunding Audits:

- 48 hour turnaround

- Targeted Reviews:

- Loan Estimate/Closing Disclosure

- Appraisal

- Asset

- Credit/Liability

- Underwriting Only

- Compliance Only

- Income Calculation

- SecondLook Audit Software for Pre-Funding, Post –Closing and Servicing

For a full range of our services or additional information regarding the services listed above please email sales@tenaco.com.